ETF Investors Anticipate a Turbulent Market and Look to ETFs to Ride Out the Storm

Two-thirds of ETF investors expect to increase allocation to ETFs in 2019

The majority of ETF investors (61%) expect market volatility to increase in the next six months, and close to half (44%) say they will put more money into ETFs as a result, according to the ninth annual ETF Investor Study by Charles Schwab & Co., Inc., a survey of 1,500 investors who have bought or sold an ETF within the past two years.

“After a decade of market gains, ETF investors now see clouds on the horizon and are planning to use ETFs to help them weather the storm,” said Kari Droller, vice president of third-party mutual fund and ETF platforms at Schwab. “It’s clear that ETFs serve a unique role for investors, as the foundation of a portfolio and also as a vehicle that enables them to be nimble.”

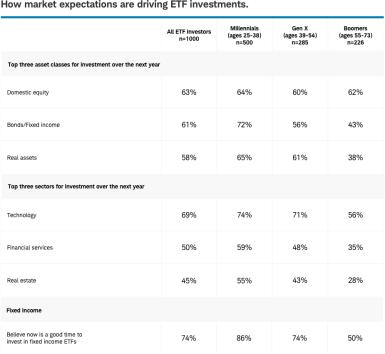

When asked about the ETF asset classes in which they plan to invest over the next year, domestic equity ETFs are the top pick (63% of respondents). For sector ETFs, more than two-thirds of ETF investors (69%) say technology is their top choice, a sentiment that is particularly popular among Millennials (74%). As investors look ahead at choppier markets, nearly three-quarters of those surveyed say now is a good time to invest in fixed income ETFs.

Performance of an ETF may be affected by risks associated with non-diversification, including investments in specific countries or sectors. Each individual investor should consider these risks carefully before investing in a particular security or strategy.

ETF Investor Study - Kari Quote

“After a decade of market gains, ETF investors now see clouds on the horizon and are planning to use ETFs to help them weather the storm. It’s clear that ETFs serve a unique role for investors, as the foundation of a portfolio and also as a vehicle that enables them to be nimble.”

Kari Droller

Vice President, third-party mutual fund and ETF platforms at Schwab

Volatility and ETFs

Already, 51 percent of respondents say they’ve increased their allocations to ETFs in the past six months after increased market volatility, and expectations for volatility are also likely impacting their plans for the coming year. Among the subset of investors who anticipate increased volatility, 73 percent expect to increase their ETF investments in the next year and 37 percent would consider placing their entire investment portfolio, excluding cash, into ETFs in the next year.

ETF enthusiasm continues to grow

The market environment aside, ETF investors continue to look to ETFs to meet their investing goals. About two-thirds (68%) of all ETF investors surveyed plan to increase ETF investments in the next year, up from 54 percent in 2018. Sixty-three percent expect ETFs to be the primary investment type in their portfolios in the future, up from 55 percent in 2018.

Results refer to all ETF investors

A deeper look by generation

Millennials lead the pack, but don’t count out Gen X

Millennials maintain their position as the most enthusiastic ETF investors by generation, but Gen X is not far behind. Forty-two percent of Millennial portfolios are currently in ETFs, on average, with Gen X portfolios at 34 percent.

Looking to the future, four in five Millennials and three in five Gen Xers expect ETFs to be the primary investment in their portfolios. Millennials are also the most likely to consider placing their entire portfolio in ETFs in the next year (44%), compared to 26 percent of Gen Xers and only 9 percent of Boomers.

A discerning eye

ETF investors care about cost, but that’s not all

ETF investors say total cost, reputation of the ETF provider and how well an ETF tracks its index are the most important considerations when choosing an ETF. When evaluating brokerages that offer commission-free ETFs, investors look for a broad selection of ETF categories and no additional fees before anything else.

To view the full study, click here

About the Study

The 2019 ETF Investor Study by Schwab is the ninth installment of an annual online survey of 1,500 individual investors between the ages of 25 and 75 with at least $25,000 in investable assets who have purchased or sold ETFs in the past two years. Conducted by Logica Research from February 20 – March 4, 2019, the study has approximately a three percent margin of error. Survey respondents were not asked to indicate whether they had accounts with Schwab. All data is self-reported by study participants and is not verified or validated.

About Charles Schwab

At Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

Disclosures

Through its operating subsidiaries, The Charles Schwab Corporation (NYSE:SCHW) provides a full range of securities brokerage, banking, money management and financial advisory services to individual investors and independent investment advisors. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. (Schwab), and affiliates offer a complete range of investment services and products including an extensive selection of mutual funds; financial planning and investment advice; retirement plan and equity compensation plan services; compliance and trade monitoring solutions; referrals to independent fee-based investment advisors; and custodial, operational and trading support for independent, fee-based investment advisors through Schwab Advisor Services. Its banking subsidiary, Charles Schwab Bank (member FDIC and an Equal Housing Lender), provides banking and lending services and products. More information is available at www.schwab.com and www.aboutschwab.com.

Brokerage Products: Not FDIC Insured • No Bank Guarantee • May Lose Value

Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares of ETFs are bought and sold at market price, which may be higher or lower than the net asset value (NAV).

© 2019 Charles Schwab & Co., Inc., All rights reserved. Member SIPC