Past CFO Commentary

The commentary in this section speaks only as of the date specified below. The company makes no commitment to update any of this information.

June 12, 2020

On May 26, 2020, we completed the acquisition of the assets of USAA’s Investment Management Company, a very important milestone for Schwab, USAA members, and the ~400 employees from USAA who joined our company. Given how much the environment has changed since we last provided specific information on this acquisition, I wanted to give you an update on certain relevant data. The transaction brought to Schwab a total of $81 billion in client assets and 1.1 million accounts, for which we paid ~$1.6 billion in cash. We also entered into a long-term referral agreement that makes Schwab the exclusive provider of wealth management and investment brokerage services for USAA members.

When we announced the transaction back in July 2019, I mentioned to you that this is a win-win-win situation, and our confidence regarding this outcome has only been solidified during the last 10 months of preparation:

- It’s a win for the USAA members who now have access to a broader choice of value-oriented investment products, while continuing to benefit from a client-focused approach for which both USAA and Schwab have been recognized time and time again

- It’s a win for the nearly 400 former USAA employees who chose Schwab as their new home, where they will continue to make a meaningful difference in the lives of investors

- And it’s a win for our stockholders as they realize the long-term financial benefits of the acquisition, as well as the opportunity for increased organic growth via the ongoing exclusive referral arrangement (which is already well underway)

This transaction represents a noticeable increase in our Investor Services footprint, adding to the segment’s asset and account bases by 4% and 12%, respectively1. The make-up of the acquired accounts remains largely in-line with what we shared with you last July:

As shown above, a quarter of the acquired assets are within USAA’s legacy managed account solution (“Managed Money”) and 82% of total client assets are invested in individual equities, ETFs, or mutual funds. Also, as part of the transaction, we successfully transitioned approximately $10 billion in client cash to our balance sheet. We now expect to deploy all of this cash within our bank portfolio in a manner consistent with our overall asset liability management framework and portfolio strategy.

During our most recent Spring Business Update we shared a range of potential financial outcomes for 2020 that included revenue and expense impacts related to the USAA acquisition. Specifically, costs associated with the nearly 400 USAA employees joining Schwab, as well as other transaction or integration-related spend, were incorporated within those expectations.

The $1.6 billion closing purchase price included certain contractual adjustments based on the underlying client assets that ultimately migrated to Schwab. We expect to incur the remaining integration expense of approximately $55 to $60 million over the course of this year, with the majority to be booked during the second quarter. I’d also remind you that starting with the upcoming 2Q20 earnings cycle, we anticipate incorporating select non-GAAP measures into our typical reporting materials.

In addition to the value created by transitioning the existing members who have utilized USAA’s investment management services, what makes this deal so appealing is the opportunity for Schwab to serve as the exclusive wealth management and brokerage provider for USAA on an ongoing basis. Through the referral agreement, USAA members will be referred to Schwab via a combination of integrated digital and live interactions, and have access to the same benefits as our existing clients. With the digital experience as the foundation of the program, we have added custom web content and enabled single sign-on for USAA members, making it easy to see their entire relationship in one place. Live referrals will come via a “warm lead” to a Schwab specialist or, alternatively, through an automated phone experience.

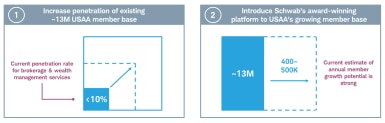

This exclusive brokerage and wealth management referral arrangement is expected to provide additional growth opportunities in two ways2:

To close, we are truly honored to have been entrusted with serving the investing needs of USAA’s current and future members. With less than 10% of the 13 million – and growing – member base currently utilizing investment services, we are excited about the opportunity to help an increasing number of these individuals pursue their financial goals. This ongoing referral arrangement will supplement our strong business momentum and enable us to make the most of this special win-win-win opportunity.

1 Based on Schwab Investor Services segment data as of March 31, 2020.

2 Current membership base and estimated annual gross member growth statistics provided by USAA.

Forward-looking statements

This commentary contains forward-looking statements relating to the USAA transaction, including financial benefits for the company’s stockholders; the growth and penetration of the USAA member base for the exclusive referral arrangement; growth in the company’s client base, client accounts and assets; the deployment of cash; estimated amortization expense; amount and timing of integration expense; and business momentum. Achievement of these expectations and objectives is subject to risks and uncertainties that could cause actual results to differ materially from the expressed expectations.

Important factors that may cause such differences include, but are not limited to, general market conditions, including the level of interest rates, equity valuations, and trading activity; the company’s ability to attract and retain clients and grow client assets; competitive pressures on pricing, including deposit rates; the company’s ability to develop and launch new and enhanced products, services, and capabilities, as well as enhance its infrastructure, in a timely and successful manner; client use of the company’s advisory solutions and other products and services; client sensitivity to rates; the level of client assets, including cash balances; the company’s ability to monetize client assets; capital and liquidity needs and management; the impact of changes in market conditions on revenues, expenses, and pre-tax profit margin; the company’s ability to manage expenses; the implementation of integration plans; the risk that expected revenue, expense and other synergies and benefits from the transaction may not be fully realized or may take longer to realize than expected; client cash allocations and cash sorting; the scope and duration of the COVID-19 pandemic and actions taken by governmental authorities to contain the spread of the virus and the economic impact; and other factors set forth in the company’s filings with the Securities and Exchange Commission, including the company’s most recent reports on Form 10-K and Form 10-Q.